- The Moment

- Posts

- The Down 'Pay-Me'nt Game.

The Down 'Pay-Me'nt Game.

Read time: 3 minutes.

At a glance:

Quote:

Picture

What I’ve Learned

Business Idea

You can be sure a practice has every reason to worry when the team tells you they have nothing to worry about.

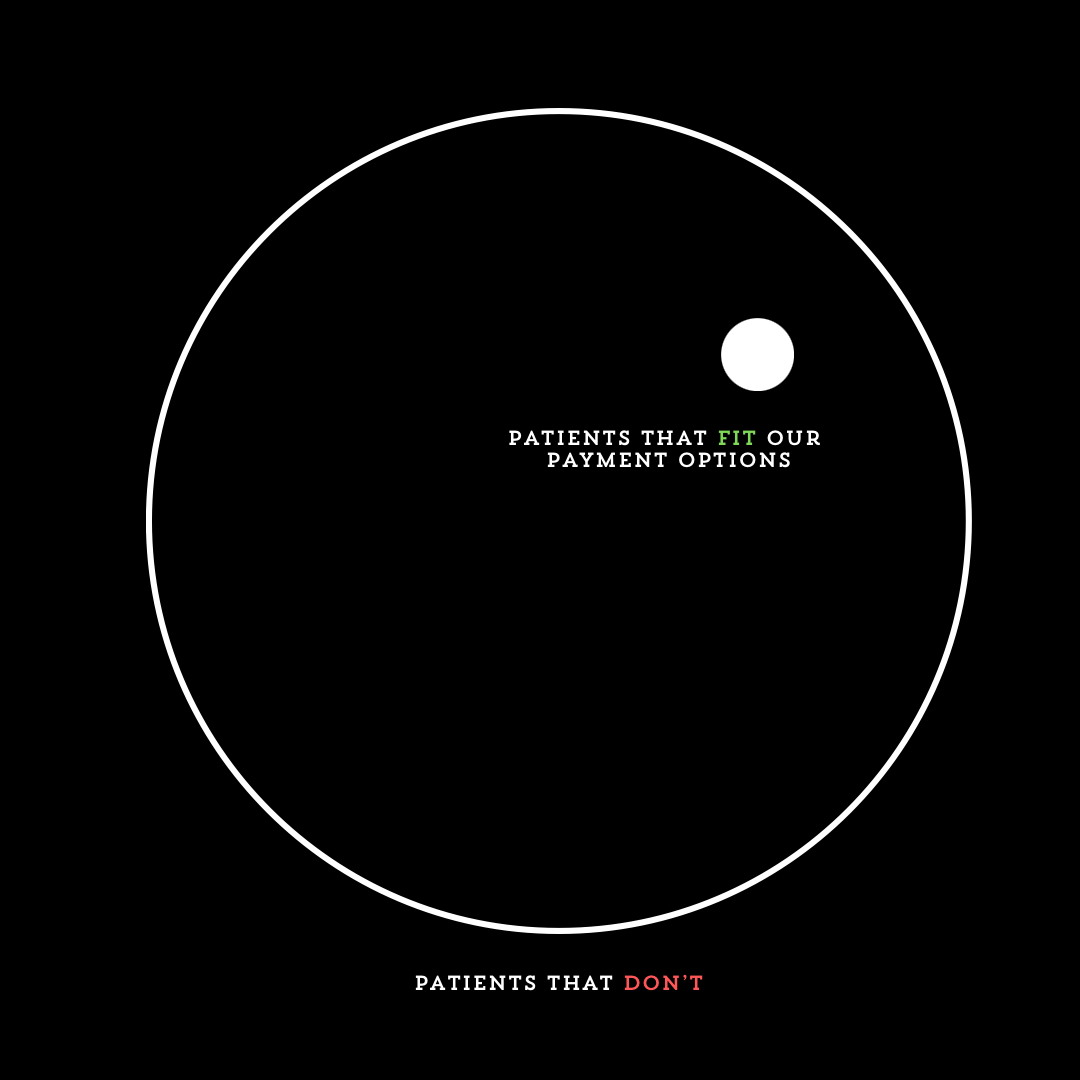

There’s a funny graph OrthoFI has on payment plans.

You can see the common area of patient payments ($500 down and $200 monthly) … but if you follow the graph's logic, the data strikes me as funny.

For example, one patient asked for a $3,500 down payment and a monthly payment plan of $99.

…but another patient started treatment with $99 down and was totally cool with $3500 in monthly payments.

Who are these people? What was their story? ..and how the hell did the orthodontic practice know to offer those options?

Oliver Gelles and Jamie Reynolds. Level the Curve. Advantage Books 2023.

Budgets and teeth are similar in that everyone’s different.

It’s common knowledge that flexible payments have a leg up in conversion - especially down payments. But there’s still practices that ask for a $2000 payment to start! And asking for a mortgage payment to start is about as attractive as starting on a steel wire bend—both will cause the patient to not speak to you for weeks.

The other factor hindering conversion in orthodontics is keeping the payment and treatment length identical. The bulk of the fee is for the expertise in diagnosis and planned biomechanics—not the hourly labor to actually execute it.

If orthodontists got paid proportionally by the length of treatment, 10+ year cases would be a bragging right at the AAO:

Here’s an easy rule of thumb: anything that gives your practice greater personalization (whether in payments, treatments, or the doctor’s personality) increases conversion and collections.

Yes, there are moments when interest or the risk of default need to take precedence.

However, most practices need to lighten up on the requirements to start and trust people to make their payments …..because most will.

Industry defaults average 1-3%, so yes, collection calls occasionally happen.

But I find it’s much more common to see a practice decline ten to prevent one than risk one for the organic growth of ten.

Be different with payments.

…Are we shooting growth in the foot based on our payment flexibility?